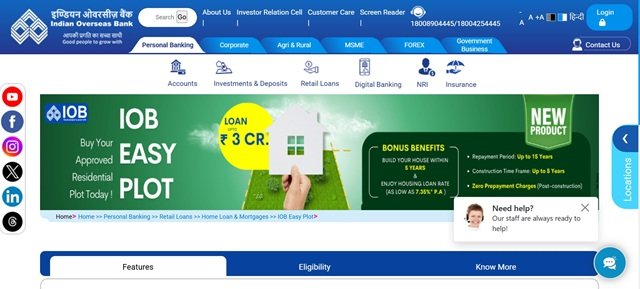

The Indian Overseas Bank has launched the IOB Easy Plot Loan Scheme 2025. Are you looking to buy a residential plot but can’t find a perfect loan for the purchase? The Indian Overseas Bank has introduced a new scheme called IOB Easy Plot Loan Scheme 2025. Under this initiative, the IOB will provide loans to the citizens who want to purchase residential plots with the purpose of building houses in the future. The loan amount under the scheme ranges from a minimum of INR 10 lakh to a maximum of INR 1 crore for semi-urban locations and INR 3 crore in urban or Metro locations.

Objective of IOB Easy Plot Loan Scheme

The main objective of launching the scheme is to allow the citizens to purchase residential plots in a government-approved location. The loan amount will significantly enhance the purchasing power of the citizens and allow them to purchase plots easily. The citizens have to pay at least 25% of the plot amount to receive the loan. The repayment period of the loan is 15 years or until the receiver turns the age of 70. The borrowers must construct a house within 5 years after purchasing the plots to receive the loan amount.

Also Read: e awas capf gov in

Key Highlights of IOB Easy Plot Loan Scheme

| Details | Information |

| Name of the Scheme | IOB Easy Plot Loan Scheme |

| Launched By | IOB |

| Launch Date | 2025 |

| Announced By | IOB |

| Purpose | Provide loan |

| Beneficiaries | The citizens must be between the ages of 21 to 60 years |

| Target Beneficiaries | The citizens must be between the ages of 21 to 60 years |

| Advantage | Loan amount of up to INR 3 Crore |

| Eligibility Criteria | Citizens who want to purchase a residential plot |

| Required Documents | Aadhaar Card, Bank account |

| Application Process | Online |

| Official Website | IOB website |

| Contact Number |

Eligibility Criteria

- The loan is available to individual Indian residents and Non-Resident Indians (NRIs) aged 21 to 60 years.

- The selected citizens must be above 55 years and must include a spouse or legal heir as a co-applicant.

- The scheme mandates that the proposed plot be SARFAESI-compliant and located in a marketable, stable area with easy transferability.

Interest Rate

- Repo Rate to be updated w.e.f 12.06.2025 as 5.50%

- Markup: 2.85%

- RLLR (w.e.f 12.06.2025) – 8.35%%

- The Effective Base Rate will be 10.00% with Effect from 15.08.2024 until further review

- One Year MCLR w.e.f 15.01.2025 will be 9.10%

- Processing charges on home and vehicle loans are waived until 31.03.2025.

Features of Loan

- The loan amount under the scheme ranges from a minimum of INR 10 lakh to a maximum of INR 1 crore for semi-urban locations and INR 3 crore in urban or Metro locations.

- The borrower has to pay a minimum margin of 25% of the accepted plot value.

- The repayment of the loan alone can be done by the borrower within 15 years or until the borrower turns 70.

- The interest rate is linked to the bank’s Repo Linked Lending Rate (RLLR) and is based on the borrower’s CIBIL score

Required Documents

- Aadhaar card

- PAN card

- Bank account details

- Passport-size photograph

Also Read: Awas Plus Data Entry

How to Apply Online for IOB Easy Plot Loan?

- STEP 1: All the citizens who want to apply for the IOB Easy Plot Loan are requested to visit the IOB website.

- STEP 2: Once the citizens reach the homepage of the official website, they must locate and click on the option called “Apply now”.

- STEP 3: The application form will appear on your desktop screen the citizens must enter all the details that are asked for and attach in necessary documents.

- STEP 4: After entering the details, citizens can click on the option “submit” to complete their process.

Helpline Number

- Toll Free: 18008904445/18004254445

Afshaan Gul is an experienced content writer with over 5 years of expertise in explaining Indian government schemes and public welfare programs. He creates easy-to-understand and informative articles that help people learn about schemes. His goal is to make complex information simple so that citizens can easily apply for and benefit from these schemes.